A Ten Billion Pound Sized Lie

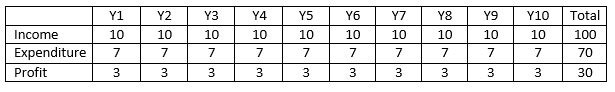

In the normal world, the world that you and I occupy, you and I and everyone else, income is income and expenditure is expenditure. So if you're XCo and you project your profits for the next ten years they'll look, let's say, like this

Table One

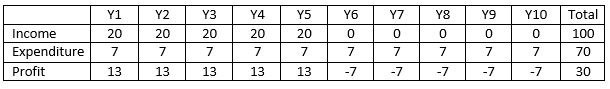

Over ten years, XCo will have 100 of income, 70 of expenditure and 30 of profits. Did I say everyone else? I meant everyone else except the Government. What Government does is look at a fixed term, typically five years, and any cash it can shovel into that five year term it treats as income. So if Government devises a legislative measure which enables it to move income in Years 6-10 to Years 1-5 it will treat that income as income of Years 1 to 5. Let's assume the Government does this with those tens in Years 6-10 in Table One. You then have a table which looks like this

Table Two

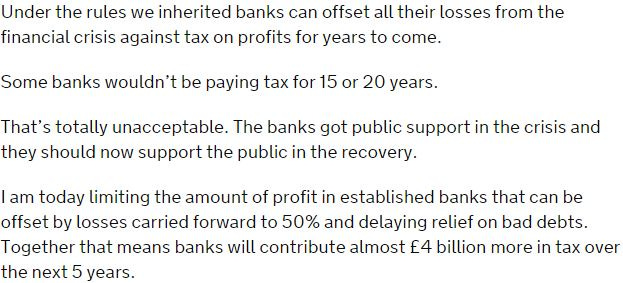

Over a ten year time frame? Same same. Same income, same expenditure and same profit. But over a five year time frame? Not so much. Profits of 65 - an extra 50. Accelerating your profits is a bit naughty - even though every little helps - but it's what the Government does with them that really stinks. Here's George Osborne on 2 December 2014 announcing the largest "revenue raising" measure in his Autumn Statement

And here's the fiscal impact of that measure (from the so-called 'Green Book'):

Take a step back. If you're making a profit today, it's rather nice to have made losses yesterday. You can set them against today's profits and use them to reduce today's tax liability. What George Osborne did was to say that instead of using all those losses today, banks would have to share them between today and tomorrow. This means banks pay more tax today - so the Government gets more income today (my Table Two). But over today and tomorrow, the banks pay the same amount of tax and the Government gets the same amount of income (compare with my Table One). Why does all this matter? Go back to my Table Two. Over Years 1-5 the Government appears to have 50 more of 'profits'. It uses these 'profits' to tell the public it has reduced the deficit. And it ignores the fact that in Years 6-10 it will be 50 worse off. And it has. And it does. But let's call this what it is. It's a lie. In no meaningful sense has the Government brought down the deficit by those five 10s. Or, putting the matter another way, it has brought down the deficit by 50 in Years 1-5 only by increasing the deficit by 50 in Years 6-10. You should be mightily cross about this. Of all the measures in the Autumn Statement, bank losses restrictions were said to have the biggest yield by far. But the actual yield from the measures is the time value of getting the money early. Which in a low interest rate environment is zero. And it gets worse. This isn't the first time the Coalition has pulled this trick. The biggest 'yielding' measure in the 2014 Budget involved an identical sleight of hand. As did the second biggest. Add those three measures together and you have a £10bn sized lie. Told in a single tax year. [twitter-follow screen_name='jolyonmaugham']