David Cameron and Corporation Tax Receipts

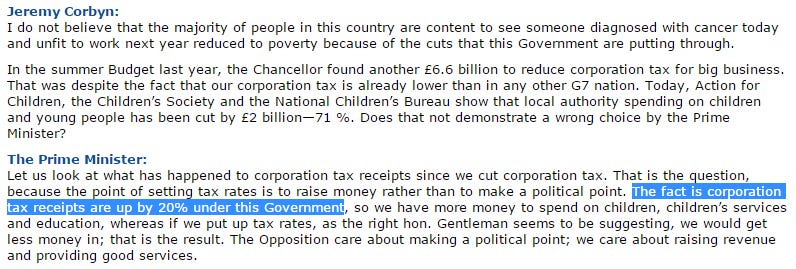

Here's what David Cameron said at PMQs this afternoon:

But is this true? Or, like George Osborne's claim on income tax receipts last week, is its relationship with the truth a fleeting one?

The General Election in 2010 was on 6 May 2010 - a month into the 2010/11 tax year.

Our corporation tax receipts in the 2010/11 tax year - according to HMRC's own figures (page 8) - were £43.040bn. In the year 2014/15 - the last year for which figures are available - they are £43.005bn.

That's not a 20% rise. It's a small fall.

Of course, it's worse than that because since 2010/11 the economy has grown modestly, tax receipts generally have grown, and there has been modest inflation. Yet corporation tax receipts have still fallen. This is exactly as HM Treasury predicted as it attributed significant costs to these cuts - £2.475bn in the year 2020-21 alone for the cut to 18% made in the Summer Budget.

Perhaps there's an explanation. But I can't see it.

[twitter-follow screen_name='jolyonmaugham']

Postscript: Iain Campbell points out that in 2009/10 receipts were (at £36.628bn) a sum a 20% increase to which gives you that recorded in 2014/15. If that is the 'explanation', Cameron is taking 'credit' for policies that Labour introduced: the first cut to Corporation Tax under the Coalition took place with effect from the 2011/12 tax year. It also invites the observation that in 2008/09 corporation tax receipts were £43.927bn: materially higher than now they are even in cash terms.