Don't be too hard on US multinational: Treasury to HMRC

The link below is to an extract from a covertly recorded 70 minute conversation between Guy Westhead, a senior member of HMRC's team dealing with VAT policy, and a Mr Richard Allen that took place in late 2015. [audio src="https://jolyonmaugham.files.wordpress.com/2018/02/excerpt-of-conversation-with-guy-westhead-in-gx-12th-dec-2015.mp3"][/audio] At the time of the conversation, Guy Westhead was a senior HMRC officer. During the conversation he described himself as being one level below the Director of Indirect Tax at HMRC. Below is a photo, taken several months after the covertly recorded conversation, of him sitting behind the then Financial Secretary to the Treasury, David Gauke. Mr Gauke was, at the time, appearing in a debate before the Backbench Business Committee on VAT Evasion and Internet Retailers.

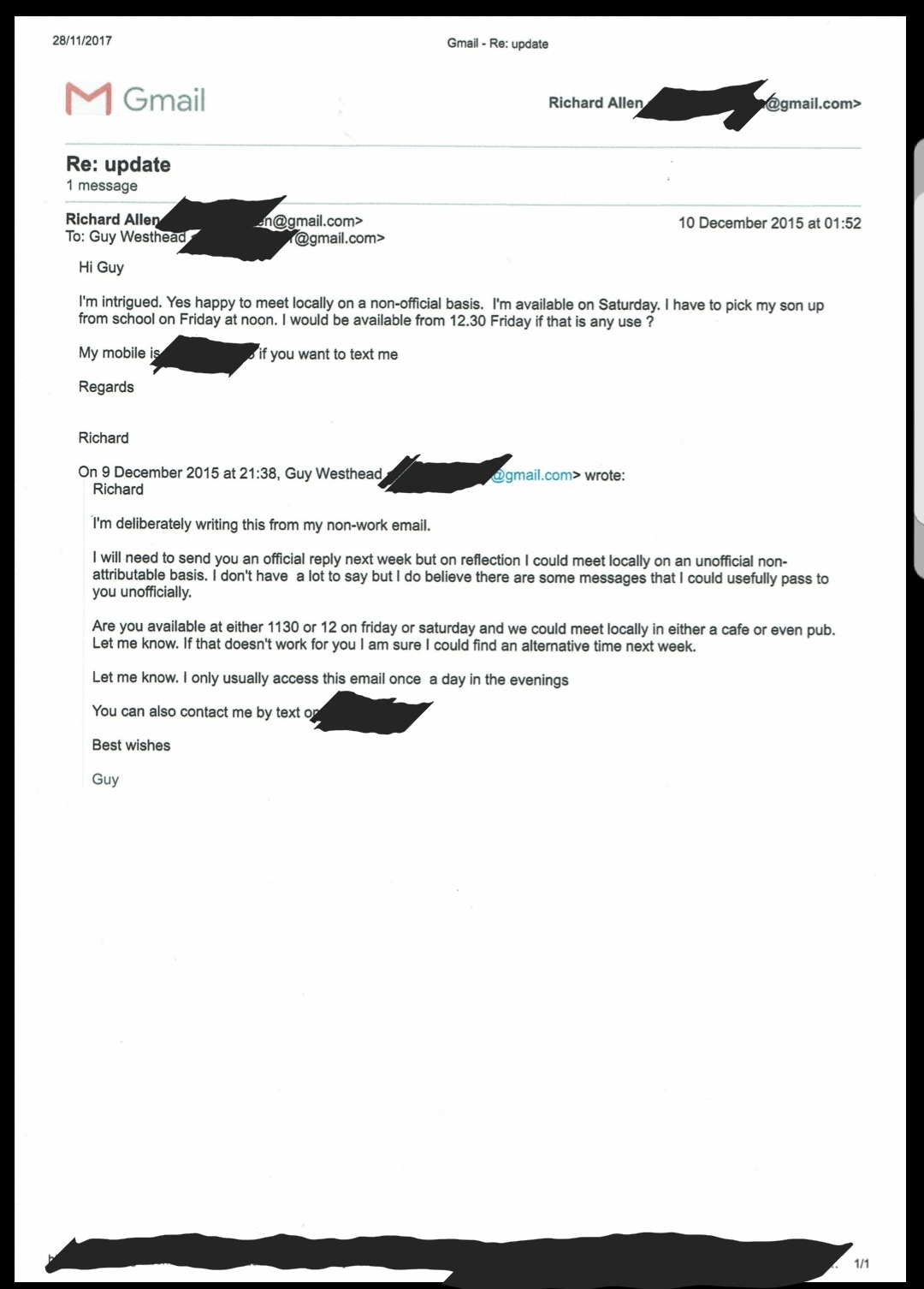

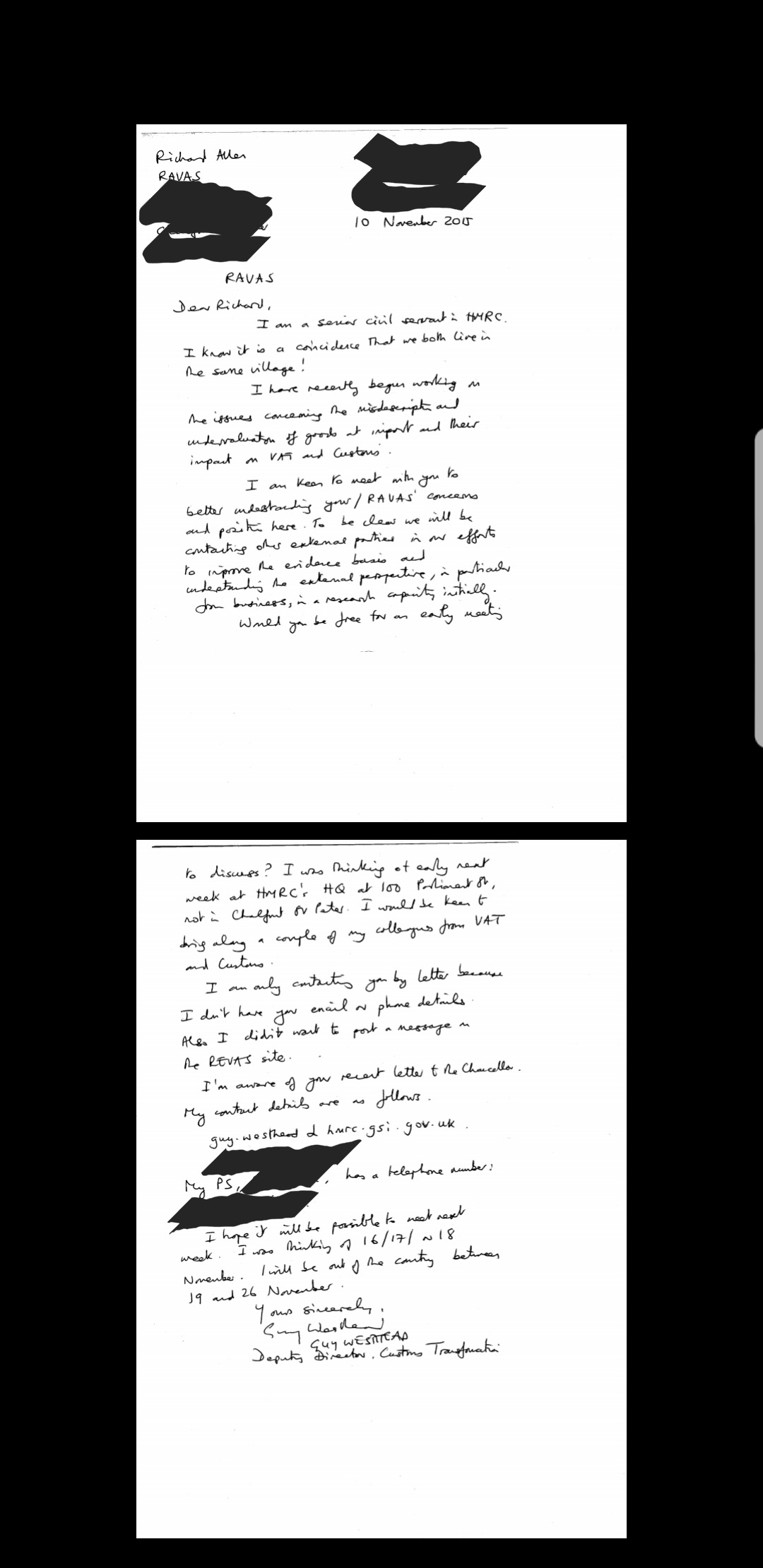

Richard Allen is an individual who has lobbied HMRC for better enforcement of VAT law. The unusual circumstances in which Mr Allen came to have and record that conversation are set out in this document: Signed Statement. The Appendices mentioned in that Statement are the photo shown above (Appendix Two) and the handwritten letter and private email posted at the bottom of this blog post. The whole recording is remarkable. It was recorded covertly and so I have not published it in its entirety. However, there seems to me to be a compelling public interest in the publication of the extract linked to above because it contains this exchange: RA: What worries me is that ministers have some kind of agenda to basically not annoy Amazon. If Amazon does something illegal Amazon has to be punished in my view. In America they tried things like “that’s it we are not building a warehouse in your State" and all this sort of stuff… GW: I’ve heard of that. I’ve heard from the Treasury; the Treasury didn’t want us to be too hard on Amazon. But I think that was a brackets “yet” close brackets. In the past, writing posts like this, I have looked at the evidence in the public domain concerned how HMRC behaves towards multinationals and I have concluded that it does not make sense. Something, I have said, is impeding HMRC's inclination to apply the law against large US tech companies (in that post, Uber). As I put it:

I can see no good reason why HMRC should adopt this stance. None at all. It is inexplicable to me – unless HMRC’s conduct is motivated by factors otherwise than collecting the tax demanded by the law. I do not know what those factors might be. But this smells very bad.

Elsewhere, I speculated: https://twitter.com/JolyonMaugham/status/923920568692412417 Both that blog post and that tweet were written before I had met Mr Allen or was aware of this exchange. However my speculations now seem well founded. This exchange is direct evidence from a senior HMRC official, speaking in his field. The issue, for me at least, is not what did or did not happen to Amazon. The issue is that the powerful and highly politicised Treasury thought it appropriate to seek to influence how HMRC exercised its statutory functions to cause it to go easy on one large and powerful US tech company (here, one accused of facilitating tax evasion). And if one why not others? [I wrote to Guy Westhead on Friday to give him an opportunity to respond and received no reply].

Appendix One

Appendix Three