Good enough from HMRC?

HMRC is responsible for collecting around £500,000,000,000 of taxes a year. So we're entitled to be interested in how it operates.

And this week has been pretty disastrous for public confidence in HMRC. There has been a growing suspicion of one rule for wealthy tax evaders who benefit both from amnesties and a policy decision to avoid prosecutions and another rule for the rest of us. These suspicions have stemmed from the disclosure that, to date, of the 3,500 or so cases investigated by HMRC arising from the Falciani disclosures of misconduct at HSBC, only three cases have been passed to the CPS and only one prosecution has been brought.

Today HMRC responded with a lengthy statement defending their record "on Tax Evasion and the HSBC Suisse Data Leak". You can read it here.

I'm not going to go through that statement line by line. On the subject of criminal prosecutions, what it does say is:

But it doesn't tell you what those convictions are for. Offshore tax evasion, presumably. But let's check.

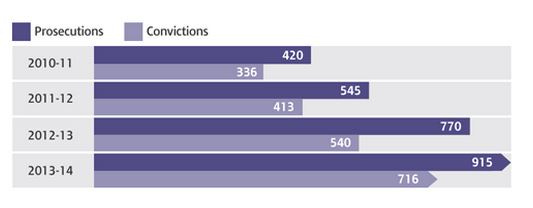

If you click on the link you get this graphic:

If you add those convictions together you get 2005. Perhaps the other 600 (of the 2,650 referred to) are Jan to Apr 2010 and Apr to Dec 2014. But the real question is whether those are convictions relating to offshore tax evasion or for all offences. Because we're not told.

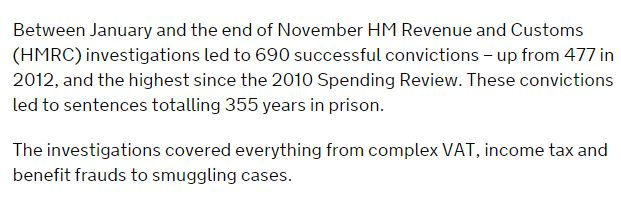

But what we do know from other documents released by HMRC (in particular this one) is that in 2013 HMRC achieved 690 successful convictions - broadly consistent with the figures set out above. What's interesting about the document linked to earlier in this paragraph is that is tells you what the convictions were for. And this is what it tells you:

Stand back from all the detail for a second.

What we know is that in a document designed to defend its record of achieving criminal convictions in tax evasion and the HSBC Suisse tax leaks - that being its title - HMRC is relying on convictions it has achieved in benefit fraud cases: cases like this:

It's possible - we don't know - that they haven't achieved even one conviction for offshore tax evasion.

That would be pretty alarming. As is the suggestion that HMRC haven't been entirely frank with us.