Google's £130m: what is it and when is it from?

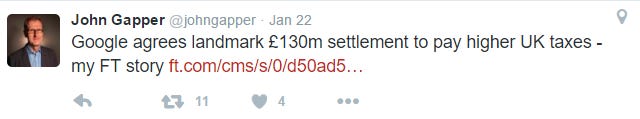

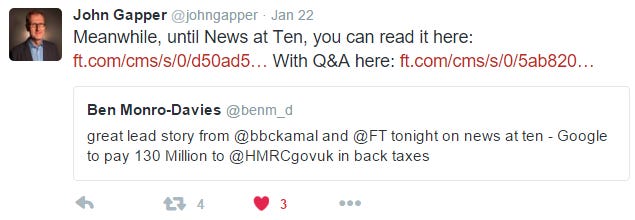

First out of the blocks on Friday the 22nd was John Gapper of the Financial Times:

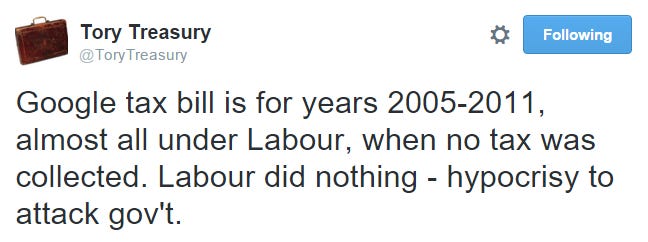

At 10am on Saturday 23rd, this is what the "Official CCHQ voice for all things Treasury" said:

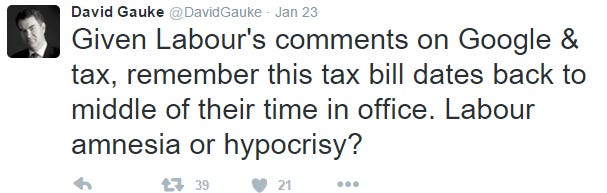

And here's what the Financial Secretary to the Treasury, David Gauke, said later that day at 1.47pm:

Labour quite properly wanted to understand whether these allegations were true.

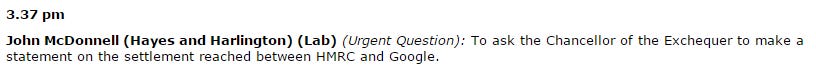

And there were also wider public concerns around whether the deal struck with Google represented a good one for the UK taxpayer. John McDonnell, Shadow Chancellor, was given permission to ask an urgent question in the Commons:

But David Gauke said he could not give further details because of the duty of taxpayer confidentiality.

But what is the £130m actually from? And to what does it relate?

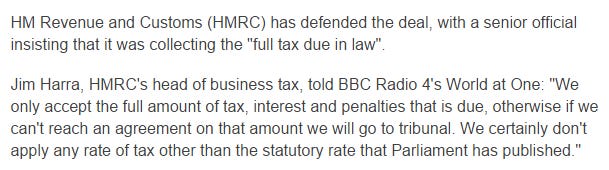

It has been widely quoted that it is from tax, interest and penalties. The source of that belief appears to lie in an interview HMRC's head of business tax, Jim Harra, gave to the BBC's the World at One.

Following a tax investigation, a taxpayer will pay any additional tax that has been found to be due, plus the interest consequential on paying that tax late.

The penalties are particularly important.

There can be modest fixed sum administrative penalties for technical slips. But penalties can also signal that a taxpayer has behaved 'badly' - negligently or fraudulently. They can send a message that a taxpayer has been held to account.

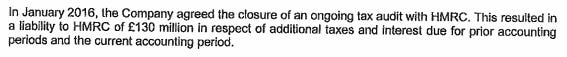

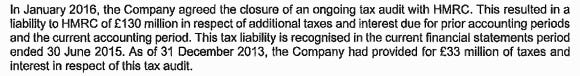

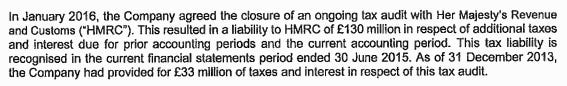

So does Google have a liability to penalties? Not according to its accounts. Only tax and interest:

I think it likely that Jim Harra was responding to a specific question with a general answer - that would be my expectation given the deep (perhaps too deep) privileging of taxpayer confidentiality in HMRC - and the press failed to grasp the context of his answer.

So, Google was not penalised.

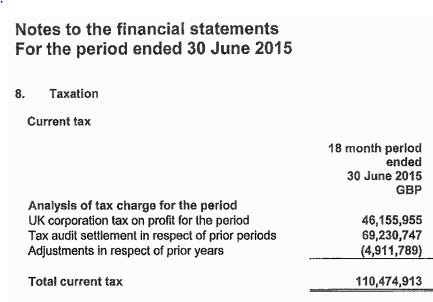

But what is the composition of that £130m figure?

First, £69m for periods prior to 30 June 2015.

Second, an existing provision of £33m:

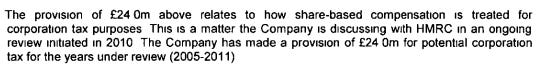

That provision first appeared in Google UK Limited's accounts to 31.12.12 as £24m:

and grew over the year to 31.12.13 to £33m.

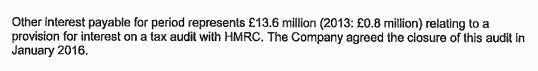

Third, interest of £14m:

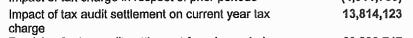

And fourth £14m of extra tax liability for the current year:

Making £130m.

And to what periods does it relate?

Here's what Google UK Limited's accounts for the period ended 30 June 2015 report:

You'll note those words "for prior accounting periods and the current accounting period". On 30 June 2015, Labour had been out of office for fully five years.

So the highly political allegations tweeted above appear to be untrue.

The £130m liability does not cover the period 2005-20111. Instead it covers a period dating back to 2005 and ending on 30 June 2015. It's 2005-2015. Including over five years of Conservative Government.