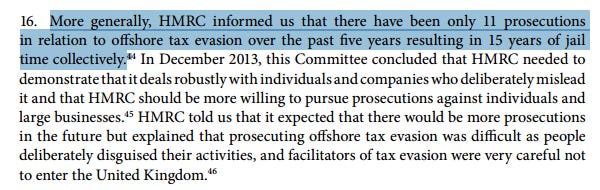

How many people has HMRC prosecuted for offshore evasion?

There's a new report of the Public Accounts Committee out today. You can read it here. Under its new Chair, Meg Hillier, it continues with many of the themes developed under her predecessor Margaret Hodge. It slams HMRC's management of tax expenditures (a subject I tackled only a few days ago here and to which I expect to return in the coming days and weeks); it characterises as "unacceptable" HMRC's customer service; and makes a number of detailed criticisms of how HMRC reports its progress on tackling tax avoidance and evasion. What I want - briefly, for the point won't take long - to focus on is some clarity the Report finally delivers on what HMRC has actually done to tackle offshore tax evasion by the wealthy. This has been a particular bug-bear of mine: I wrote a number of times on the issue in the early Spring culminating with this. And the new PAC report very much franks my analysis stating, starkly:

HMRC’s investigations do not lead to sufficient prosecutions to provide an effective deterrent, particularly for wealthy individuals who hide their assets offshore.

It then sets out this startling statistic:

That's right, eleven in the last five years. For scale, we know that the HSBC disclosures led to HMRC becoming aware of the names of 3,600 potential evaders - and in consequence HMRC "encouraged" 500 people to take advantage of the Liechtenstein Amnesty. Offshore tax evasion really has been, as Margaret Hodge put it, "a risk worth taking" (see Question 102 here). But worse even than that is what that number - eleven in five years - reveals about HMRC's attitude to public reporting. Back at the height of the furore around HMRC's handling of the HSBC data - and in the run up to a General Election where it was a key political issue - HMRC released this document, entitled: 'Statement by HMRC on tax evasion and the HSBC Suisse data leak.' At the time, I was deeply sceptical of some of claims made in that document. I said:

What we know is that in a document designed to defend its record of achieving criminal convictions in tax evasion and the HSBC Suisse tax leaks – that being its title – HMRC is relying on convictions it has achieved in benefit fraud cases.

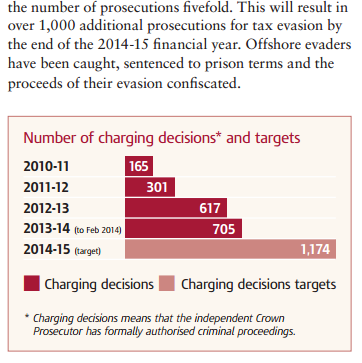

And that conclusion too is franked by this morning's PAC report. Here's an extract from HMRC's 2014 annual report on tackling offshore evasion: 'No Safe Havens.' And at page 11 it contains this table:

revealing 2,962 actual and prospective charging decisions. Did only 11 of those lead to convictions? No. We can now conclude that by including that table - which includes charging decisions for such matters as wrongfully claiming tax credits - HMRC set out to mislead you as to its success in tackling offshore tax evasion. Not lying - because the document does not explicitly state that those are charging decisions in relation to offshore evasion - but an attempt to mislead. That's a serious charge - so don't take my word for it. Have a look at that table and the context in which it appears. Look at the document and at the page. It appears in a document about offshore tax evasion. As the screen-grab above shows, it appears at the end of a paragraph talking about offshore tax evasion. Nowhere I can see in that document is it made clear that that table has nothing to do with offshore evasion.

***

There is some evidence that the Government is at long last taking tax evasion seriously. You can see here a series of consultation papers on new civil and criminal matters. Let's hope those measures are delivered. Let's hope they are utilised by HMRC. Let's hope they work. Because the Coalition Government and HMRC's response to offshore tax evasion by the wealthy was a disgrace.