Jeremy Corbyn and Pensioners

Writing in Tuesday's Telegraph, Jeremy Corbyn said that nearly two million pensioners live in poverty. He called for an increase in the single tier state pension to the minimum income standard figure of £182.16 per week from £144 per week. This step, Corbyn said, would cost £22bn.

Do these claims stack up? Is this the right policy?

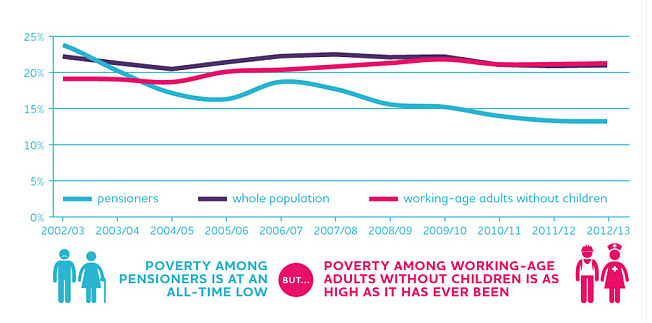

The article comprising the supposed source of the "nearly two million" claim (entitled, somewhat unhelpfully for Corbyn: 'Pensioner poverty at an all time low - but the young lose out') contains no such figure. It does, however, give this chart

which (as the headline suggests) shows that pensioners as a demographic group are privileged: they have poverty rates of just above a half of the population as a whole. Indeed, as research released by the JRF on Tuesday revealed:

Median pensioner income (after housing costs) is now actually above that of the non-pensioner population

But what of the "nearly two million" claim?

Corbyn's source article draws on research conducted by the JRF and released in November last year. If one looks at that research one finds (see page 26) figures for pensioner poverty of 1.6 million (using the DWP's "contemporary measure") or 1.8 million (using the "fixed measure"). But these figures date from 2012-13, since which time the basic state pension has risen by pretty much double the rate of inflation and so will overstate the number of pensioners in poverty. "Almost 2 million" looks a little like what some call 'political rounding' but others might call disingenuous.

Perhaps more importantly, the JRF research shows, again, that pensioners occupy, demographically, a uniquely privileged position.

Pensioner poverty is now at a record low level; from having a greater risk of poverty than the rest of the population in the 1980s, pensioners now have the lowest poverty of any age group. But as that has happened, poverty among working-age adults has risen, and has never been higher than it is now.

Of course, there is no such thing as good poverty. But the act of picking out the least poor demographic and showering it with non-means tested goodies requires some explanation. Not least because in 2012-13 (the figure will be even higher now) 87% of pensioners didn't live in relative poverty. What is the case for benefiting them, whilst 3.7m or 4.1m (page 26) children live in poverty? Sadly Corbyn gives none.

What is the explanation for non-means tested benefits rather than targeted help for the poorest pensioners? Again, there is none.

Surely it can't be found in the inclination of pensioners to vote? Surely?

As to the cost of raising the single tier state pension to £182.16 Corbyn gives this as £22bn. But he's not at all clear how it will be funded: here's what he says:

Illuminating, this is not.

Corbyn has previously argued for an increase in the top rate of income tax to 50p but of late seems to have backed off that a little. The only comprehensive research on what such an increase would raise suggests a yield of around £100m (less than half a percent of the £22bn needed). But that research is well out of date - and there isn't room for sensible doubt but that the same measure in 2020 would raise significantly more. But there are limits to how much the rich can be taxed. The UK is no longer in the 1980s when personal income tax rates hit 60%. The make-up of our economy, the shape of our tax burden, the mobility of our highest earners, all of these things have changed. And changed in a way that makes it less rather than more easy to impose higher rates of tax on the rich.

£22bn is a big number - beyond that which can be yielded by increasing taxes on the income of the rich. And, purely for scale, to raise £22bn through the basic rate would involve increasing it by 6p.

And all to benefit the least disadvantaged demographic we have.

Perhaps there is another £22bn out there for those 4 million children living in poverty, and another £22bn for the 8 or 9 million working age adults also in poverty? Perhaps there is a brave new world in which all shall have prizes? And all funded by our favourite type of tax - the one paid by someone else? But if I'm to be asked to subscribe to the existence of such a utopia, I'd like to know a little more first about how it all stacks up.

[twitter-follow screen_name='jolyonmaugham']