On EBTs and Rangers FC – Part 2

Writing here, I explained how Employee Benefits Trust work and why they were used for tax planning. But I also promised to try and explain why the decision of the Court of Session in the Rangers case seems to me to be wrong. And to look at what happens next. But first, let me repeat my warning from Part 1:

If you’re a tax specialist you’ll also need to make allowances for the fact that this piece isn’t written for you. I make no apologies for not capturing in these posts the full technical detail around Employee Benefits Trusts.

***

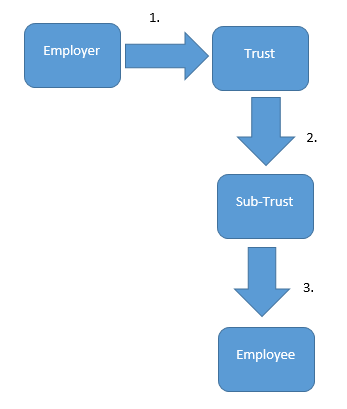

As I said in Part 1, to have a liability to pay income tax you need to have something that is "income" - but you also need to “get” that thing. If you work hard for three years and your employer pays you a bonus in year three because of all of that work do you have a liability to pay income tax in year one? There is income from that year, after all? I give you this example because what I think the Court of Session has got wrong, in summary, is to focus too much on the income and too little on the getting. But let me take it a bit more slowly. You might think about the Rangers transaction as looking a little like this. (And sorry for my home-made diagram. You need to make allowances for us lawyers.)

What happens at 1 is that the employer gives money to the trust - think of it as a big pot - for all employees. At 2 the trust gives money to the sub-trust - a smaller pot - for a particular employee and his family. And at 3 the sub-trust lends the money to the employee. So when does the employee "get" the income? When does he have a liability to pay income tax? Of course he gets his hands on the cash at 3. But all the courts so far have held that what he has is a loan of the money - which he may need to repay. And at 2 the money is passed to the sub-trust for the benefit of the employee and his family. But all the courts so far have held that the employee hasn't got it - because the trust might decide to give it to someone else - for example his daughter - instead. Now everyone involved kind of knew the money would just flow straight through from employer to trust to sub-trust to employee. And the loans don't look the same as a loan you might take from a bank - no-one's been demanding that the loans should be repaid. So you might feel that what the courts have held doesn't have much reality to it. But as I said on Good Morning Scotland, the law isn't always about common-sense. And what's more important now is that they're not conclusions a judge can overturn on an appeal. So what about at 1? Might there be a payment there? Because the new argument HMRC advanced before the Court of Session was that the employees got the income at 1. But how, you might ask, could they have got it at 1 if they didn't get it at 2? Isn't it odd that at 1 it could have been given to any employee but at 2 it could only have been given to the employee or his family? How could it be the employee's income at 1 if it wasn't at 2? Well, the answer the Court of Session gave was this. You can satisfy the "getting" bit of the test for a liability for income tax in two ways. You can satisfy it if you get the money yourself. Or you can satisfy it if you agree that it should be paid to someone else. There's definitely something to this argument as a matter of principle. Think about it this way. Most of you won't receive your wages through some complex EBT structure. Most of you will receive them directly from your employer. And you couldn't avoid income tax on them by agreeing that they should be paid into your daughter's bank account rather than your own. And what the Court of Session said had happened here was, in effect, that the employees had agreed that they should be paid into the EBT (at 1) rather than to them. And by agreeing, they had satisfied the requirement that they "get" the income. But, although that might be right in principle I have some problems with the practice. The first is that the Court of Session seems to me to see the "getting" requirement as a problem to be solved rather than a key part of the question. And I think this may have led it to the second and third problems. The second is that the Court of Session is not terribly clear - or not terribly clear to me, at any rate - about where you can find the agreement that someone else should be paid the income. But I should also make this point. There were two different types of arrangement before the Court of Session: one for footballers and one for managers. And this criticism I have advanced of the Decision may be stronger for managers than for footballers. Because footballers did enter into an agreement (called a side-letter) when they signed with Rangers in which they seem to have agreed that payments should be made to an EBT rather than to them. But Managers didn't sign an agreement - although they too were found by the Court of Session to have agreed. The third is that we are taxed on our actual pay - and not on what we might have been paid had we negotiated a different package with our employer. We are free (at least if we do it right) to agree with our employer a package that involves us getting less stuff that does give rise to a tax liability (for example, pay) and more stuff that doesn't give rise to a tax liability (for example, child-care vouchers or pension contributions). And if we make that choice then we pay (the lower) tax on our actual pay package rather than (the higher) tax on what we might have negotiated. I'm not sure that the Court of Session fully appreciates this.

***

It's not easy for an outsider - like me - to look at a case and say what the answer should be. The answer is often quite sensitive to the facts. The advocates arguing the case - and the judge or judges hearing it - know those facts better than the outsider does. And that's a particular problem in this case. I'm not sure why - perhaps it's because the Court of Session decided the case on an entirely new argument - but the facts relevant to this new argument are not terribly clear from the Decision. So, although I stand by the problems I have set out above with the Decision, it is perfectly possible that my analysis is wrong. You know this, of course. But it's important that I say it.

***

But actually my views are not nearly as important as what happens next.

If there is an appeal to the Supreme Court either I will be proved wrong or I will be proved right. And whatever my view is now will be irrelevant.

And if there isn't an appeal to the Supreme Court then the fact I think the Decision is wrong will also be irrelevant - because it will remain the Decision. And no-one will care if someone somewhere (me, for example) thinks it's wrong.

So will there be an appeal?

I don't want to speculate about the financial position of whoever's running the litigation. There are other people around who are better informed than me on that subject.

But if there is money to fund it I'm pretty sure there will be an appeal. It would be an odd decision to stop at your first loss, having won twice. That's especially true where you've lost on a 'new' point. And it's especially, especially true where that new point is controversial. I can put my hand on my heart and say that all of the tax professionals I have spoken to about the Decision find it difficult to see how it can be right. They might all be wrong - but that sort of sentiment towards the Decision is absolutely going to encourage rather than discourage an appeal.

***

Thanks for sticking with me this far. Even I know that tax is less fun than football.

I know it now, anyway. So I appreciate you sticking around. And I've enjoyed engaging with many of you on twitter.

Please come back for Part 3 where I'm going to talk about what I find particularly interesting about this case. Which is what I think it tells us about who the real winners and the real losers are from this kind of tax avoidance.

[twitter-follow screen_name='jolyonmaugham']