Once might be unfortunate. But twice?

As I've made the point on twitter:

https://twitter.com/JolyonMaugham/status/694513748132888577

let me spell it out here.

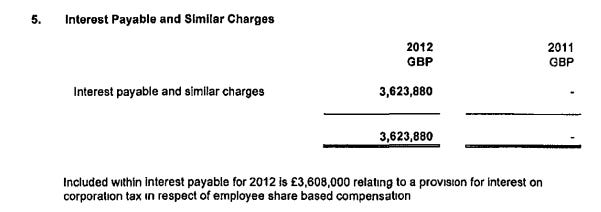

I've traced Google UK Limited's accounts back to 2008. The first sign of trouble comes in 2012 where we see for the first time a provision for underpaid corporation tax:

in respect of employee share based compensation. We can reasonably assume a deduction had wrongly been taken for tax purposes. Call this the First Dispute. And there is a corresponding interest charge to reflect the fact that at least some of this additional tax has been owed for some time:

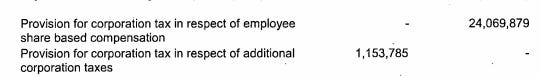

In 2013, there's then a new and separate provision "in respect of additional corporation taxes":

You'll notice that it occupies a separate line in the accounts to the £24,069,879 figure carried over from 2012 and has a separate description. Call this the Second Dispute.

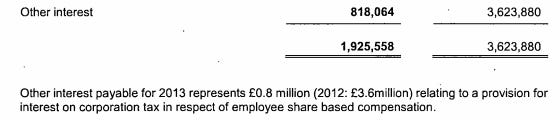

And there's also a further interest charge.

which is said to relate to the First Dispute.

Now roll the clock forward to the (as yet unpublished - but I have a copy) accounts for the period ending 30 June 2015. You can see a substantial additional provision to that recorded in the accounts for the period ending 31.12.13:

Although the accounts for the period ending 30 June 2015 don't explicitly record that the provision is for the Second Dispute, the fact that it is compared with the prior period £1,153,785 (which obviously was for the Second Dispute) strongly suggests that some or all of it relates to that dispute.

As I indicated here, there is also in the accounts for the period ending 30.6.15 a further provision for interest of £13.6m. If you assume that some or all of the £69m related to the Second Dispute the amount of this interest charge would suggest that the Second Dispute, too, is of venerable age. And from the timing of the provision you can see that either HMRC uncovered - or Google conceded - the point late in the day.

So. Two longstanding disputes as to Google UK Limited's UK corporation tax bill. Both involving tens of millions of pounds of underpaid tax.

One might be unfortunate. But, two?