Some brief thoughts on Facebook's accounts

Facebook UK Limited - which I'll call UK Facebook - has published its accounts for the year ending 31 December 2014. Heather Stewart of the Guardian has written about them here. I wanted to add a few points of my own.

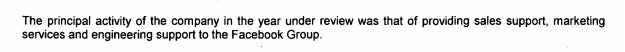

First of all, don't be fooled into believing that these accounts tell you anything about what advertising revenue or profit Facebook makes from UK based advertisers, or advertising targeted at UK consumers. UK Facebook's business is this:

So its business is providing services to what I'll call Real Facebook.

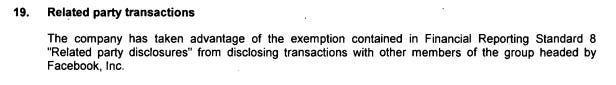

Second, UK Facebook could have chosen to tell us a little more about the transactions it enters into with Real Facebook. But, as is its right, it didn't:

I don't suggest there's anything legally wrong in it having declined to disclose this material. But it seems - to me at least - a strange decision for a company whose tax affairs are very much in the public eye. It could have taken the view that its reputation would be better served by transparency - but it didn't. And people are bound to ask the question, 'why?'

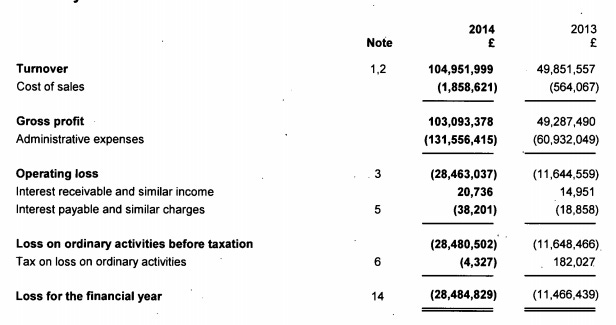

Third, its accounts show a more than doubling of turnover from 2013 to 2014:

Most businesses' profitability improves when they double their turnover. But not UK Facebook's: its pre-tax loss actually increased from 23% of turnover in 2013 to 27% of turnover in 2014. That's not a feature most people would expect to see in a rapidly growing normal business.

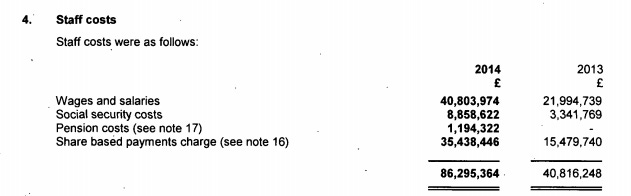

Fourth, another notable feature of UK Facebook's accounts is its huge staff costs:

These are obviously substantial: as a proportion of turnover they were 82% in 2014. But, perhaps even more remarkably, they are static as a proportion of turnover: in 2013 they were also, yep, 82%. Again, that's not a feature most people would expect to see in a rapidly growing normal business. You'd expect staff costs as a proportion of revenues to decline as a business increases in size.

Now, the most likely explanation for this is that UK Facebook charges its services - largely consisting of its employees - out to Real Facebook on a cost plus basis. I'm not suggesting that there's anything unlawful about this. But it does rather imply that UK Facebook may well never make a profit. Because what are described in its accounts as its revenues are really just its staff costs multiplied by a number (here 1.22). And that extra 0.22 may well never be enough to cover office costs, fixed assets and so on.

Certainly that 82% (or 1.22 multiplier) ratio suggests that the UK taxpayer won't ever enjoy meaningful profits from whatever success Real Facebook enjoys in the UK.

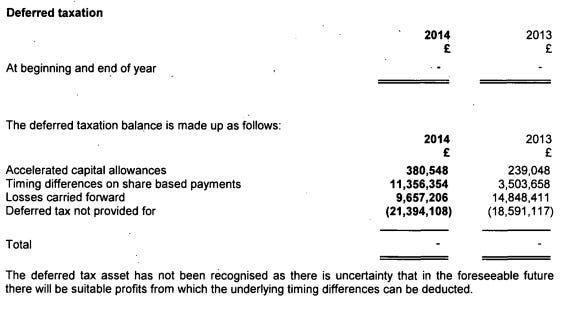

Indeed, that seems to be UK Facebook's own view. Its accounts set out how it treats its deferred tax assets (basically, the right to set past losses against future profits) and states:

And does UK Facebook recognise deferred tax assets?

It does not.

Finally, Heather's article is attracting some criticism from the twitter intelligentisa for failing to recognise that, by paying remuneration in the UK, UK Facebook is actually increasing its UK tax liability. That criticism seems to me to be misplaced for a number of reasons.

Even if you assume that all of the remuneration it pays in the UK is paid to UK resident employees, the net effect of doing so is that its employees acquire an income tax (and modest NICs) liability. And UK Facebook acquires a liability to pay Employer's National Insurance Contributions of 13.8%. That rate is lower than the rate of corporation tax (likely to be 21% depending on timing) on profits diminished by the payments to employees.

You want to be careful not automatically to assume that, because the staff are employed by UK Facebook, it follows that they pay tax on their employment income in the UK. For example, if UK Facebook engages staff who are resident in the US, it is the US, not the UK, that has main taxing rights in respect of the income of those staff. So UK Facebook could be depleting its profits chargeable to UK corporation tax by paying salaries to staff resident elsewhere on which salaries no UK income tax liability accrues and which still deplete the corporation tax liability of UK Facebook.

Moreover, the average staff member enjoys a remuneration package with an average cost to Facebook of £238,000. No one pays their staff that unless there's pretty vigorous competition for the services of those staff. It's at the very least very possible that, if Facebook wasn't paying them here, someone else would be.

In any event, clearly, it's no defence for X, facing an allegation that it doesn't pay the appropriate amount of corporation tax, to say: 'well, I've done some other things that the law requires of me.'

[twitter-follow screen_name='jolyonmaugham']