Some tentative thoughts on a sugar tax

It's a tough business trying to structure a sin tax.

Because your purpose is somewhat confused. Although we readily think of alcohol and tobacco we might also include amongst sins discouraged by taxation flying, quarrying, landfill and no doubt others too. Usually we tax exclusively to raise revenue but not so with sin taxes. Speaking of air passenger duty John Healy, in 2003 Economic Secretary to the Treasury, said in a written answer:

Air passenger duty was introduced in 1994 as a measure whose principal purpose was to raise revenue from the aviation industry but with the anticipation that there would be environmental benefits through its effect on air traffic volumes.

Are you trying to maximise revenue? Or dissuade commission of the sin? And if dissuade, how much? A little bit, presumably, because if you really wanted to dissuade, you'd ban it.

It's tempting to say these considerations plague the design of sin taxes. But that would suggest, falsely, an elevated status for design. You either fudge it - no, you usually fudge it - or you take intellectual dignity from looking to raise a particular sum of money to spend on countervailing measures. Take this example from the 2001 Budget:

And they can be regressive, sin taxes. Can, because assertions that they invariably are (see, for example, from the Adam Smith Institute):

should be treated with some caution. It all depends on how they're structured.

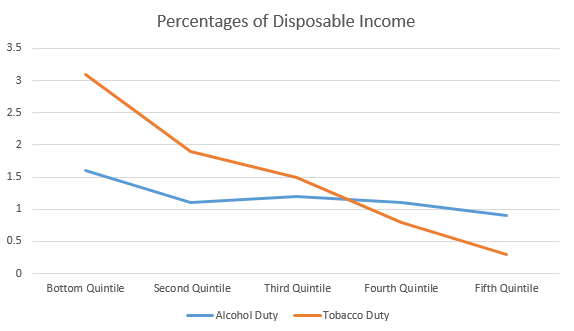

The proportion of your disposable income consumed by tobacco duty, for example, falls sharply as your income rises. But with alcohol, not so much (source: ONS).

Indeed, the percentage of our expenditure - as opposed to our disposable income - we expend on alcohol duty is absolutely static as we rise up the income scale (see Table 3(c)).

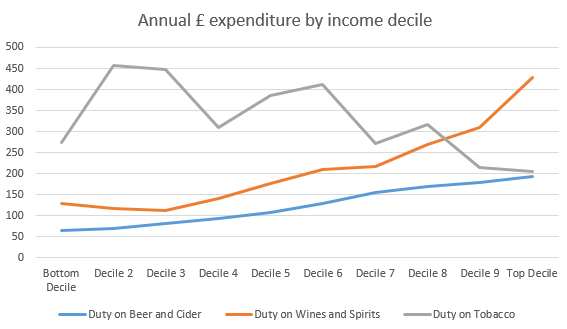

These points emerge even more powerfully if you look in cash terms (see Table 14).

So the rich smoke less, but drink more, than the poor. I know I do - and I'm pleased I'm not alone.

You'd want to be careful drawing conclusions from this data. But you might tentatively draw a few.

(1) It's not taxes that discourage the better off from smoking. Although the disincentivising effect of tobacco duty declines as you rise through the income deciles still the rich smoke less. This lower propensity to smoke must derive from something else.

(2) People drink more as they can afford to (Oscar Wilde was wrong: work isn't the curse of the drinking classes at all). And this suggests that alcohol duty does suppress consumption at its present level - and would suppress consumption more if raised.

(3) If you were inclined to conclude that the rich smoke less because they're better educated as to the dangers of smoking you'd then have to answer the question why they drink more. This might drive you to conclude that social fashions play a part too.

Are there any implications for a sugar tax? Some tentative ones.

(1) You might start by noting that alcohol and tobacco have no (legal at any rate) substitute goods. The decision you face is to consume or not to consume. But increasing the price of sugary foods and drinks might more readily cause consumers - especially price sensitive ones - to switch to alternatives.

(2) The data on correlations between obesity and income is more complicated than you might think. Whilst for women obesity seems clearly to be correlated with low income the picture is less clear for men. But where there is a relationship, a sugar tax will be regressive - if it's set at a level where the poor will pay it. The higher the level at which you set it, the more likely the price sensitive consumer will switch to products not covered by the tax. A sugar tax could easily be like alcohol duty - barely regressive at all.

(3) The mixed picture around alcohol and tobacco duties suggest that factors other than affordability are important too. Changing social mores may well rank high amongst them. Perhaps you would earmark revenues - as with the aggregates levy - to fund measures to achieve that change. And to offset the effect on the poor of price rises on sugary foods - by encouraging thrifty and health eating.