That Google Deal

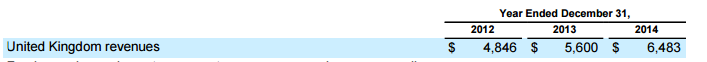

Here's what Google Inc (the Company then at the top of the Google Group) reports to its investors about UK revenues.

That's $6.5bn. Assume an exchange rate of £1:$1.60. That's around £4bn (plus £62m of loose change).

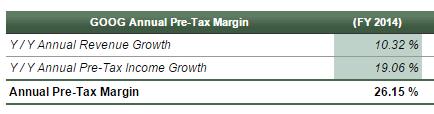

We know it makes a margin of about 26%. Here's what one analyst says:

Others give about the same.

And that's a margin for all revenues - you'd expect it to be higher in the markets in which Google is already established, but leave that aside. And assume a rather lower 25%. That gives you a notional UK profit of £1bn.

We have a corporation tax rate - the equal lowest in the G20, alongside Saudi Arabia; Russia and Turkey - of 20%. But it would be nice if companies actually paid it. And on that notional UK profit figure Google's tax liability would be £200m. In a logical world that's what we'd get from Google in tax revenues.

John Gapper, writing in the Financial Times, said this about Google's tax settlement yesterday:

Annualised, that £46.2m represents £30m per annum. That's an effective tax rate on that notional £1bn of UK profits of 3%. (And for scale, that £30m is only half the amount of the "loose change" I ignored above.)

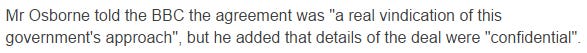

Here's what Osborne said about that deal (quoted by the BBC here):

I'm perfectly prepared to believe it vindicates something. But you might wonder what.

And hang on a second. What happened to that £1bn of UK profits I mentioned at the start? What's this £106m for 18 months (or about £70m a year) that John Gapper mentions?

The answer is that it has nothing at all to do with the revenues Google Inc tells its investors have been made in the UK. Nothing to do with them at all.

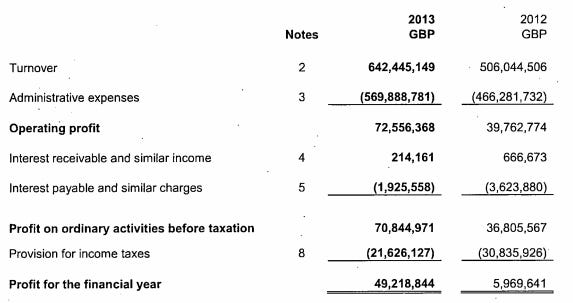

It has come from Google UK Limited's new accounts - which have been shown to selected journalists but not to me. Never mind. We can look at their last filed accounts.

Yep, about £70m of profit. More or less the same figure as that annualised for the 12 months to June 2015. But what is that profit actually on?

Well, here's what Google UK Limited does.

Now, that doesn't sound much like selling advertising. And it isn't. Its business is selling services to other Google companies. And it will charge a modest uplift on its costs - and that modest uplift will comprise its profits.

A consequence of this is that Google UK Limited's accounting profits will never bear any relationship to the profits Google Inc chooses to report to its shareholders as having been generated in the UK. Those profits generated in the UK will never show up in Google UK Limited's accounts and be subject to UK tax. Google UK Limited is never going to be hugely profitable.

Indeed if Google Ireland Limited and Google Inc were to choose to buy those services from some other jurisdiction, Google wouldn't generate any accounting profits here at all.

The accounting profits they generate here they generate because they choose to buy services from here. They choose to make profits here.

But what about the Diverted Profits Tax? It was introduced with some fanfare just before the General Election. I was a rare enthusiast. The tax community hated it and the business community hated it but I thought it was a brave measure. I wrote about it on a number of occasions - but you might start here. Will it make a meaningful difference to Google UK Limited's tax liability?

Well, the evidence suggests not.

The Diverted Profits Tax came into force on 5 April 2015. And the settlement with HMRC squares off Google UK Limited's tax liability until June 2015 - or three months after the Diverted Profits Tax was introduced. And it increases Google UK Limited's tax liability by £13.8m. Even if you assume all of that is attributable to the Diverted Profits Tax - an impossible assumption given that we know Google UK Limited also has back taxes to pay for other periods pre-dating the Diverted Profits Tax - and you annualise it, you still only get £55m.

Even with the tax already payable, still significantly short of the £200m that in a logical world Google UK Limited would be paying.

Speaking in Davos, Osborne also described the deal between Google and HMRC as a "major success".

Well, clearly it was in publicity terms.

For a third of the annual price to Barclays of sponsoring the Premiership, that £13.8m of additional tax has generated a blizzard of favourable publicity for George Osborne, Google and HMRC.

But for the UK taxpayer? Not so much, I think.

[twitter-follow screen_name='jolyonmaugham']