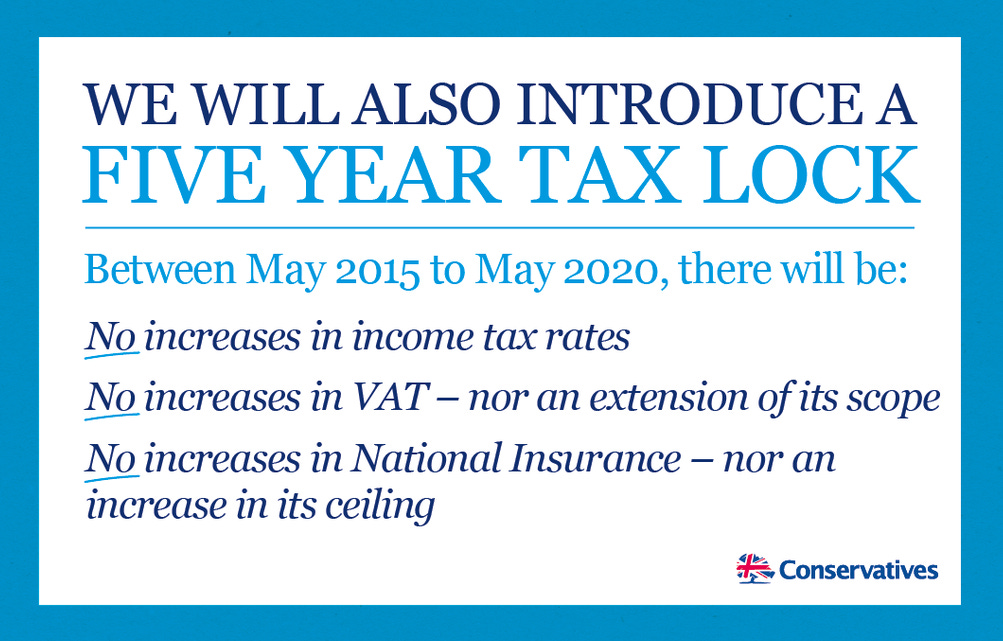

The Conservative's Five Year Tax Lock

Here is David Cameron tweeting out the Conservatives 'Five Year tax Lock':

Others have made the argument that to pledge not to change the law signals a breakdown in trust in politics. No one has made it better than George Osborne did in 2009. Here's him in Hansard:

I'm not sure I could have put it better myself.

Leaving aside the fact that Parliament could perfectly well introduce a Finance Act with a tax rise, and that would crack the 'lock' by impliedly repealing the legislation introducing it, what does the 'lock' actually mean? I've seen a few loopholes in my time so let me tell you.

Assuming the above to be the extent of the 'lock' the Tories could, consistently with it, do any one of the following things:

Subject benefits to income tax.

Lower the threshold at which NICs were paid, a measure that would hit the poorest hardest. Note that the Conservatives pledge only that they won't increase the ceiling not that they won't reduce the floor.

Jettison reliefs from income tax - for example on childcare, or pension contributions - or national insurance contributions. The loss of these reliefs can have a profound impact on your tax bill.

Amend the thresholds at which different tax rates were paid. Such an amendment could increase or decrease the tax bill of any individual.

There is no pledge in relation to inheritance tax, capital gains tax, corporation tax, stamp duty, air passenger duty, and so on. Increases in all of these taxes remain entirely possible - if not likely.

The Conservatives could reduce the VAT registration threshold, compelling hundreds of thousands of small businesses to charge VAT on their sales.

I could go on, and on. But what's the point: even if you assume the 'lock' is adhered to, it's all but meaningless.

Note: I have amended to add the first bullet point.