The Tax Gap, Updated

This morning saw the release of new Tax Gap figures for 2013/14. Here are some highlights.

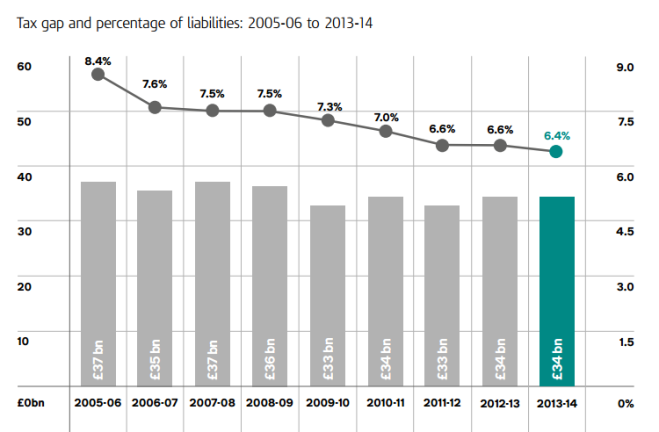

In cash terms the Tax Gap remained static at £34bn but in (the more meaningful) percentage terms it fell from 6.6% to 6.4%.

What can we ascertain from these figures about HMRC's performance if we dig a little deeper? (This question reflecting, as I observed here, that the Tax Gap is better understood as a performance metric than an anti-austerian's El Dorado?)

This chart probably sums it up best.

For me, the stand-out trends are these.

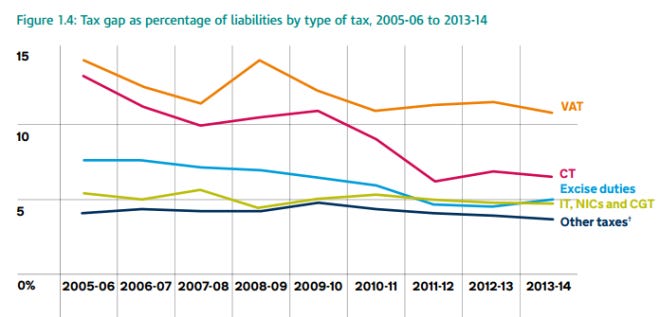

First, we are beginning - for the really radical measures will take effect only in the tax year 2014-15 - to see the fruits of the Coalition's success in tackling personal tax avoidance. One can also see this trend (more starkly still) in the slump in the disclosure to HMRC of tax avoidance schemes (for those interested, I have discussed that slump here).

Second, we also see (in relation to excise duties) the effects of the very substantial cuts to HMRC's FTE staff (more on this below) in the excise gap figures. The Summer Budget appears to have recognised the deleterious effects of these cuts:

(although the cynic in me notes that no figure was there given as to what that additional resource would look like).

But perhaps the most interesting question is what the future will look like. For we are, it seems to me at least, at an inflection point.

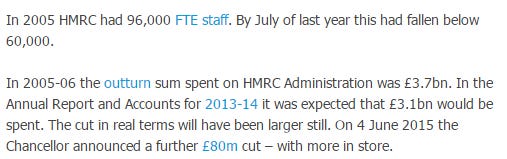

As I noted here, HMRC has sustained very substantial cuts in budget and staffing numbers since 2005-6:

My perception is that the progress - despite these cuts - in closing the tax gap reflects a number of different trends.

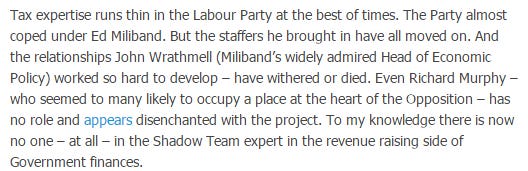

First, (see here and here) the Conservative Party is presently culturally better equipped to tackle avoidance and evasion than is Labour. The problems of avoidance and evasion are complex and will not be solved by a purity of moral purpose alone. Likely it is that my colleagues on the left will react to this assertion with outrage. But it is common ground across the left spectrum: see this, for example, which I co-wrote with Richard Murphy. And under Cobyn the problem has become worse not better as I noted here:

My intention is that Labour should react, not with outrage, but by recognising the issue and moving to address it.

Second, a consequence of their expertise is that the Conservatives have been able to alleviate the effects of cutting resource through some radical legislative steps: the General Anti Avoidance Rule, Follower Notices, Accelerated Payment Notices, Direct Recovery of Tax Debts to name but a few. There is much more to do - as the Conservatives rightly recognise - in particular around offshore evasion by wealthy individuals which, in consequence of campaigning work done largely on the Left (to which I have been a modest contributor), has risen up the political agenda.

But legislative steps are an imperfect solution. They are imperfect because they cannot address the resource heavy areas of smuggling, the shadow economy and so on. Technological advances - see this piece from the Telegraph on HMRC CONNECT - can assist but we also need investigators.

Perhaps more profoundly, they are imperfect because they create imbalances in the system. Over time they will erode - indeed, they are already eroding - the reputation HMRC has previously enjoyed for fair dealing. I hear this frequently from business leaders - and it is borne out by my personal experience too. If this situation goes unalleviated - and my conversations with senior HMRC staff suggest it will accelerate rather than diminish - it will cause serious harm to HMRC's ability to collect tax and to the investment climate. This is a very real concern.

However, third, in the short and medium term, I expect these figures to improve. The tax avoidance figures next year will show the effects of the adoption in the Finance Act 2014 of a slew of radical legislative measures - and there is more to come from further legislation in subsequent Acts. And at some stage soon - although the current data records no such trend - we will see some modest benefits from a growing focus on evasion. Modest, because unless someone is brave enough really to tackle the shadow economy, our scope for improvement is limited.