The UK's tax competitiveness

Here's what the FT reported this morning:

Ouch. That doesn't sound so good. More tax cuts for multinationals must be the answer, right?

That's what you'd think from the responses from Government:

But is that really what the KPMG 'league tables' show? Do we really need "further improvements" (for them, that is. You and I would probably describe it as collecting even less tax from multinationals)?

Here's the KPMG Survey. It has lots and lots of questions comparing our 'tax competitiveness' with that of other nations. And business is asked over and again what would help our 'tax competitiveness'. And they have lots of suggestions which result, unsurprisingly, in them paying less tax.

But when I take my three daughters into an ice-cream parlour and ask them whether they'd like ice-cream they tend to say yes. There's not a single question in the KPMG report which seeks to assesses whether those tax breaks are in any way decisive of a decision to invest here or not.

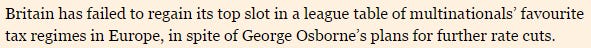

This is close as the reports gets:

You'll note the tiny sample size. You'll also note that "high influence" is counted together with "some influence (and is not disaggregated). It could perfectly well be - indeed I would guess - that the number saying it has "high influence" is lower than the number saying it has "no influence."

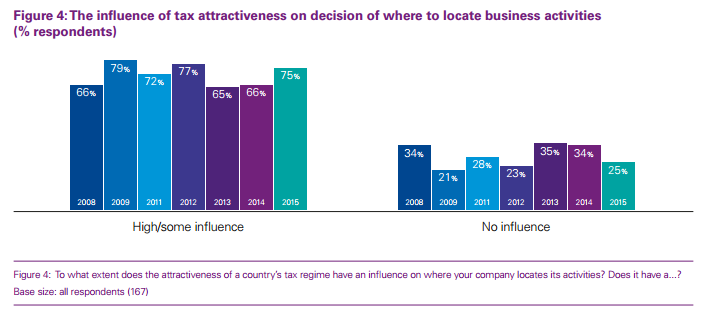

You don't believe me? Well, here's what the selfsame KPMG survey showed in 2014 (where they did disaggregate 'high' and 'some'):

In 2013, the number saying the tax regime has "no influence" on where they located their activities was a staggering 350% of the number saying "high influence".

And the report contains no analysis at all of the costs and the benefits for us as a nation of cutting the tax burden on business.

You see, at 20% we already have a corporation tax rate which is by far the lowest in the G7 and the joint lowest in the G20. Those other G20 nations with a 20 per cent rate? Russia, Saudi Arabia and Turkey. And are there really businesses contemplating setting up in Saudi Arabia who might be induced to set up here instead with a 2 per cent cut in corporation tax?

Nine years ago the rate of Corporation Tax was 30 per cent; today it is 20 per cent. In his 2015 Budget Osborne announced plans to cut it further to 18 per cent. That cut alone will cost £2.5bn in its first year. And that's not my number, by the way. It's HM Treasury's own number - you can read it at Table 2.1 here. So "tax attractiveness" carries a very meaningful cost.

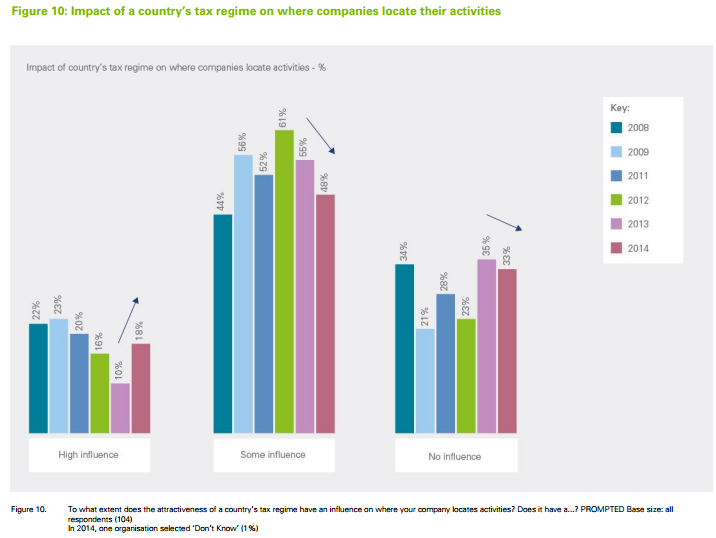

And the effect on Foreign Direct Investment in the UK - not the only measure of success, granted, but perhaps the one most applicable to the KPMG survey? Here's the ONS's chart.

In 2005, our rate of corporation tax was 30%. As it was in 2007.

You might think the KPMG report is a naked pitch for business to pay less tax. Dressed nicely for dinner, for sure, the better to be able to engage policy-makers and the electorate. And journalists. But still, just a pitch.

What do we actually get for foregoing the tax revenue - the "further improvements" described by Treasury? The effects of the greater "tax attractiveness" described by KPMG? And is it worth it?

We have no idea.

[twitter-follow screen_name='jolyonmaugham']